Palau Chamber Of Commerce Fundamentals Explained

Wiki Article

Some Known Details About Palau Chamber Of Commerce

Table of ContentsPalau Chamber Of Commerce Can Be Fun For EveryoneOur Palau Chamber Of Commerce StatementsPalau Chamber Of Commerce Can Be Fun For AnyoneAll About Palau Chamber Of CommerceThe Single Strategy To Use For Palau Chamber Of CommercePalau Chamber Of Commerce Things To Know Before You Get This

While it is secure to claim that most philanthropic organizations are respectable, companies can absolutely endure from several of the same corruption that exists in the for-profit corporate world. The Message found that, in between 2008 as well as 2012, greater than 1,000 not-for-profit companies examined a box on their internal revenue service Kind 990, the income tax return form for excluded companies, that they had experienced a "diversion" of assets, implying embezzlement or other fraud.4 million from purchases linked to a sham service started by a former assistant vice president at the company. An additional instance is Georgetown University, that suffered a considerable loss by an administrator that paid himself $390,000 in additional payment from a secret financial institution account formerly unidentified to the university. According to government auditors, these stories are all as well usual, as well as function as cautionary stories for those that venture to produce and run a philanthropic company.

When it comes to the HMOs, while their "promo of wellness for the advantage of the neighborhood" was deemed a philanthropic function, the court determined they did not run mainly to benefit the community by providing wellness services "plus" something added to benefit the community. Hence, the revocation of their exempt status was maintained.

How Palau Chamber Of Commerce can Save You Time, Stress, and Money.

By comparison, 501(c)( 10) companies do not offer for repayment of insurance coverage benefits to its participants, therefore might set up with an insurance provider to offer optional insurance without jeopardizing its tax-exempt status.Credit unions and also other shared financial companies are classified under 501(c)( 14) of the internal revenue service code, as well as, as part of the financial market, are greatly controlled.

Federal credit score unions are organized under the Federal Credit Union Act as well as are tax exempt under internal revenue service code Area 501(c)( 1 ). Other lending institution and also nonprofit monetary organizations are covered by 501(c)( 14 ). State-chartered cooperative credit union need to show that they are chartered under the appropriate state credit rating union regulations. In our following component, we will consider the requirements and steps for including as a not-for-profit.

Get This Report about Palau Chamber Of Commerce

Getty Images/Halfpoint If you're considering starting a nonprofit organization, you'll wish to comprehend the various kinds of nonprofit classifications. Each classification has their very own demands as well as conformities. Below are the kinds of not-for-profit designations to assist you make a decision which is ideal for your company (Palau Chamber of Commerce). What is a not-for-profit? A nonprofit is an organization operating to enhance a social reason or sustain a common mission.Gives payment or insurance coverage to their members upon health issues or various other traumatic life occasions. Membership should be within the same workplace or union. Usage membership because of support outdoors causes without settlement to participants. Establish and take care of teachers' retired life funds.: Exist exclusively to assist in the funeral proceedings for participants.

g., online), also if the nonprofit does not straight get donations from that state. Additionally, the internal revenue service needs disclosure of all states in which a nonprofit is signed up on Form 990 if the nonprofit has income of even more than $25,000 annually. Fines for failure to register can consist of being forced to offer back contributions or facing criminal fees.

The 8-Minute Rule for Palau Chamber Of Commerce

com can aid you in signing up in those go right here states in which you plan to solicit donations. A not-for-profit company that obtains significant portions of its earnings either from governmental sources or from straight payments from the general public may qualify as a publicly supported organization under section 509(a) of the Internal Income Code.

A nonprofit company with service places in multiple states may develop in a single state, then sign up to do service in other states. This indicates that nonprofit companies should formally sign up, file yearly records, as well as pay annual fees in every state in which they conduct business. State regulations need all not-for-profit companies to maintain a registered address with the Secretary of State in each state where they work.

The Single Strategy To Use For Palau Chamber Of Commerce

A Registered Representative gets and also forwards important legal records and also state correspondence in support of the business. All firms are normally called for to submit annual records and also pay franchise fees to the state in which they're incorporated; however, nonprofits are often excluded from paying franchise business costs. In enhancement, nonprofits are normally required to yearly restore their enrollment in any state in which they are registered.Area 501(c)( 3) philanthropic organizations might not interfere in political projects or perform considerable lobbying activities. Get in touch with an attorney for more certain information concerning your company. Some states only call for one supervisor, yet the bulk of states require a minimum of three supervisors.

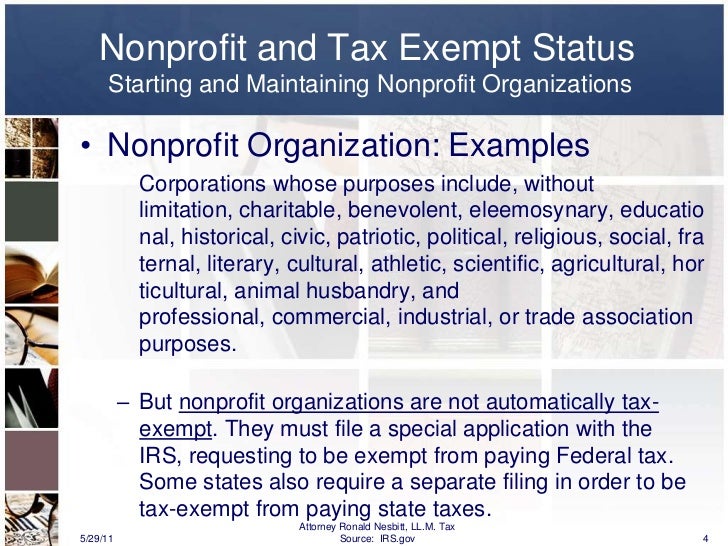

An enterprise that serves some public purpose and therefore takes pleasure in special treatment under the legislation. Nonprofit corporations, unlike their name, can earn a profit yet can not be designed mainly for profit-making. When it concerns your service framework, have you considered arranging your venture as a not-for-profit company? Unlike a for-profit organization, a nonprofit may be eligible for sure benefits, such as sales, building and income tax exemptions at the state degree.

The 10-Minute Rule for Palau Chamber Of Commerce

With a nonprofit, any type of money that's left after the company check out here has paid its click this link bills is placed back into the company. Some kinds of nonprofits can obtain contributions that are tax obligation deductible to the person that adds to the organization.Report this wiki page